In The Spotlight

Canfor Pulp Products and Canfor Corporation recently released their joint 2023 Sustainability Report, outlining their environmental, social, and governance (ESG) efforts and progress towards established goals.

The Forest Enhancement Society of British Columbia (FESBC) is playing a key role in advancing sustainable forestry practices in Northwest B.C.

Last Thursday, the eucalyptus bioproducts giant, Suzano, initiated construction works for its new tissue paper factory in Aracruz, Espírito Santo.

Benefit from the expertise of the Groupe PMI, a leader in turnkey solutions for your industrial projects and the maintenance of your process equipment.

Ahlstrom, a global leader in sustainable specialty materials, has initiated a consultation process regarding the potential divestment or closure of its Bousbecque plant in France.

In a strategic move aimed at streamlining its operations, West Fraser announced the successful completion of the sale of its Quesnel River Pulp mill and its Slave Lake Pulp mill.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its March 2024 Packaging Papers Monthly report.

Cleveland, OH, April 18, 2024: Radix, a global technology solutions company, announced its participation as a Sapphire sponsor at TAPPICon 2024, which is being held at Huntington Convention Center in Cleveland, OH, from April 28 - May 1, 2024.

More vacuum alone may not be the answer

Feature Articles

Top Stories

Canfor Pulp Products and Canfor Corporation recently released their joint 2023 Sustainability Report, outlining their environmental, social, and governance (ESG) efforts and progress towards established goals.

The Forest Enhancement Society of British Columbia (FESBC) is playing a key role in advancing sustainable forestry practices in Northwest B.C.

Last Thursday, the eucalyptus bioproducts giant, Suzano, initiated construction works for its new tissue paper factory in Aracruz, Espírito Santo.

Ahlstrom, a global leader in sustainable specialty materials, has initiated a consultation process regarding the potential divestment or closure of its Bousbecque plant in France.

In a strategic move aimed at streamlining its operations, West Fraser announced the successful completion of the sale of its Quesnel River Pulp mill and its Slave Lake Pulp mill.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its March 2024 Packaging Papers Monthly report.

April 16, 2024 - Earlier today, Forest Products Association of Canada (FPAC) President and CEO Derek Nighbor released the following statement in response to the 2024 Federal Budget tabled by Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland.

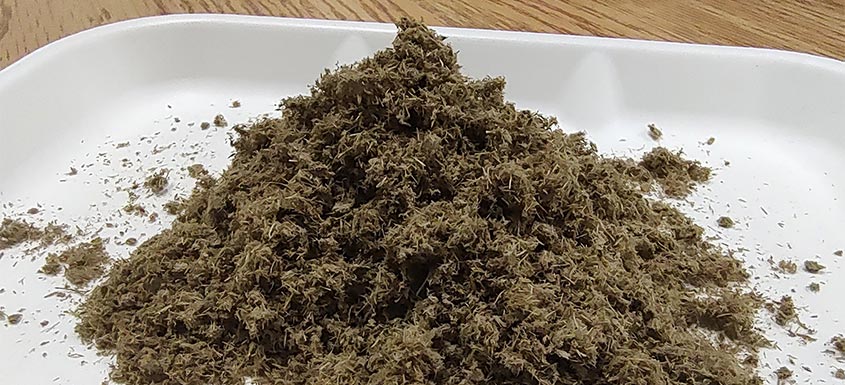

Cellulose packaging is booming. In recent years, we've seen the arrival - on the Quebec market - of cellulose packaging from other regions of the world.

With the ongoing momentum in corporate sustainability initiatives, the collaboration between pulp and paper companies and major corporations to create sustainable alternatives for their product lines is on the rise.

Sustainable forest management is essential to the Canadian paper packaging industry and its circular economy.

In a blog article last year, I wrote about the potential of high-temperature heat pumps (HT-HPs) to save energy in papermaking.

When looking forward at the forces that are likely to drive the direction of the pulp and paper industry over the next 15 years, decarbonization and supporting a circular economy are at the top of the list.

In an era where environmental consciousness is not just a trend but a necessity, businesses across the globe are taking significant strides towards sustainability

Benefit from the expertise of the Groupe PMI, a leader in turnkey solutions for your industrial projects and the maintenance of your process equipment.

More vacuum alone may not be the answer

Multiple-barrel pressure filters are designed to remove contaminants from a liquid filtration process while providing high cleaning efficiency, low flow restrictions, and easy maintenance.

Eleven years in the making: Our Menominee (Michigan) recycled bleached kraft pulp mill has exceeded 2.25 million hours without a single recordable safety incident.

Montreal, Canada: Doug Wall, Vice President Global Sales, is pleased to announce that Paprima has secured two new strategic international orders for our industry-leading Reel-Jet™ S Water-Jet Turn-Up System.

Landau, 18.04.2024 – On 15 April, Beate Flamm joined the Board of the containerboard and corrugated sheetboard manufacturer Progroup.

Recognising the importance of recyclability for the circular economy, Sappi has established a recyclability testing laboratory within its R&D Department.

In the realm of sustainable solutions, UPM emerges as a frontrunner, investing strategically in the biochemical industry. This move isn't just about business; it's a testament to their commitment to a future less reliant on fossil fuels.

Cleveland, OH, April 18, 2024: Radix, a global technology solutions company, announced its participation as a Sapphire sponsor at TAPPICon 2024, which is being held at Huntington Convention Center in Cleveland, OH, from April 28 - May 1, 2024.