In The Spotlight

More vacuum alone may not be the answer

Multiple-barrel pressure filters are designed to remove contaminants from a liquid filtration process while providing high cleaning efficiency, low flow restrictions, and easy maintenance.

Eleven years in the making: Our Menominee (Michigan) recycled bleached kraft pulp mill has exceeded 2.25 million hours without a single recordable safety incident.

Ever grab a paper cup for your morning coffee? They're handy, keep things clean, and convenient for on-the-go.

Landau, 18.04.2024 – On 15 April, Beate Flamm joined the Board of the containerboard and corrugated sheetboard manufacturer Progroup.

Montreal, Canada: Doug Wall, Vice President Global Sales, is pleased to announce that Paprima has secured two new strategic international orders for our industry-leading Reel-Jet™ S Water-Jet Turn-Up System.

DALLAS,

VANCOUVER, British Columbia, April 16, 2024 - Western Forest Products Inc. (TSX:WEF) (“Western” or the “Company”) today announced the indefinite curtailment of its Alberni Pacific Division (“APD”) facility, located in Port Alberni, B.C.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its March 2024 Packaging Papers Monthly report.

Feature Articles

Top Stories

Ever grab a paper cup for your morning coffee? They're handy, keep things clean, and convenient for on-the-go.

DALLAS,

VANCOUVER, British Columbia, April 16, 2024 - Western Forest Products Inc. (TSX:WEF) (“Western” or the “Company”) today announced the indefinite curtailment of its Alberni Pacific Division (“APD”) facility, located in Port Alberni, B.C.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its March 2024 Packaging Papers Monthly report.

WASHINGTON – The American Forest & Paper Association (AF&PA)released its March 2024 Printing-Writing Monthly report.

In a significant strategic move, International Paper has announced its agreement to acquire DS Smith Plc, marking a pivotal moment in the packaging industry.

April 16, 2024 - Earlier today, Forest Products Association of Canada (FPAC) President and CEO Derek Nighbor released the following statement in response to the 2024 Federal Budget tabled by Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland.

Cellulose packaging is booming. In recent years, we've seen the arrival - on the Quebec market - of cellulose packaging from other regions of the world.

With the ongoing momentum in corporate sustainability initiatives, the collaboration between pulp and paper companies and major corporations to create sustainable alternatives for their product lines is on the rise.

Sustainable forest management is essential to the Canadian paper packaging industry and its circular economy.

In a blog article last year, I wrote about the potential of high-temperature heat pumps (HT-HPs) to save energy in papermaking.

When looking forward at the forces that are likely to drive the direction of the pulp and paper industry over the next 15 years, decarbonization and supporting a circular economy are at the top of the list.

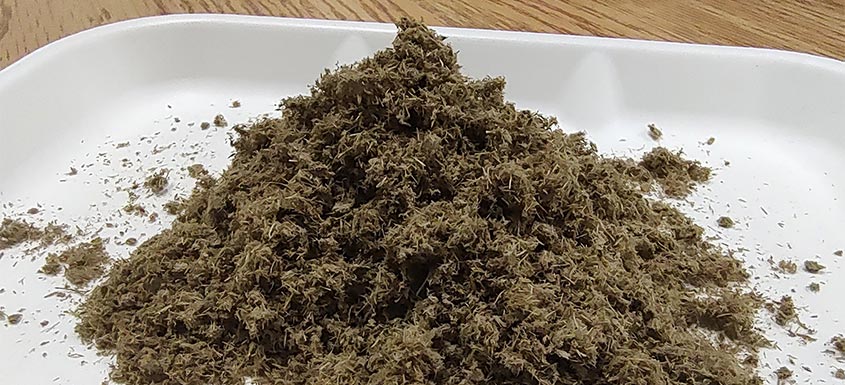

More vacuum alone may not be the answer

Multiple-barrel pressure filters are designed to remove contaminants from a liquid filtration process while providing high cleaning efficiency, low flow restrictions, and easy maintenance.

Eleven years in the making: Our Menominee (Michigan) recycled bleached kraft pulp mill has exceeded 2.25 million hours without a single recordable safety incident.

Montreal, Canada: Doug Wall, Vice President Global Sales, is pleased to announce that Paprima has secured two new strategic international orders for our industry-leading Reel-Jet™ S Water-Jet Turn-Up System.

The new tissue machine is supplied by RePlus Tissue

The crush strength of the core refers to the capacity of a material to withstand pressure.

Landau, 18.04.2024 – On 15 April, Beate Flamm joined the Board of the containerboard and corrugated sheetboard manufacturer Progroup.

Recognising the importance of recyclability for the circular economy, Sappi has established a recyclability testing laboratory within its R&D Department.

In the realm of sustainable solutions, UPM emerges as a frontrunner, investing strategically in the biochemical industry. This move isn't just about business; it's a testament to their commitment to a future less reliant on fossil fuels.

Time Tested, Future Forward: Celebrating Corrugated’s Storied Past and Bright Future