Europe’s Lumber Market Tightens as Demand Recovers and Supply Constraints Deepen by 2030, a new outlook report finds

Europe is a major player in global softwood lumber markets, accounting for about one-third of global production and one-quarter of net exports—second only to Canada. From 2000 to 2024, European lumber output grew slowly at 0.4% per year but still outpaced domestic demand growth, according to the new report Softwood Lumber – Tariffs, Turbulence and New Trade Flows to 2030. This allowed Europe to expand exports overseas, a trend likely to continue as Russian and Canadian shipments remain constrained. Consequently, Europe’s importance as a global supplier—particularly to the US and the MENA region—is expected to rise, although forest policy and sawlog availability will remain key limiting factors.

After eight years of steady growth, European lumber demand fell in 2022–24 as high interest rates slowed construction, the primary driver of wood consumption. Europe still accounts for 27% of global demand, and with interest rates now easing, a gradual rebound is expected through 2030, returning demand to more typical long-term levels.

Production has expanded faster than demand, with exports rising from 10% of output in 2009 to 19% in 2024. Growth has been concentrated in Northern and Central Europe—led by Sweden,

Finland, Germany, and Austria—where harvest levels are now close to structural limits. A significant factor shaping future log supply has been the bark beetle outbreak in Central Europe. From 2018 to 2021, harvests surged from 158 to 183 million m³ annually due to large-scale salvage logging, as roughly 400 million m³ of timber were damaged, approximately 90% of which were softwood species. Damage levels have since declined, and harvests have fallen back. With less salvage available and a gradual shift toward more mixed-species forest management, Central Europe is projected to see a further reduction of softwood logs by 2030.

Future production growth will therefore depend increasingly on Northern and Eastern Europe. Germany, Czechia, and Austria are reducing harvests and will likely revert to being net sawlog importers. Meanwhile, Romania, Poland, and—when stability returns—Ukraine have strong expansion potential. Several smaller producers, such as Slovenia, Scotland, and France, also have the capacity to grow. Altogether, Europe has the potential to increase softwood sawlog harvests by approximately 15–20 million m³ by 2030 compared to 2023 levels.

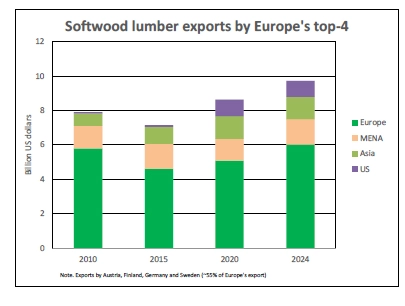

European export patterns have shifted significantly. The importance of overseas markets has increased from 27% of total exports in 2010 to almost 40% in 2024 (see chart). Shipments to the US grew more than tenfold between 2015 and 2022 but declined in 2023–24 as North American demand softened. Exports to China rose strongly until 2020, then fell sharply, while MENA has remained a stable anchor market for European exporters. Overall exports are likely to remain broadly flat to 2030 as domestic demand strengthens and supply tightens, the report finds. However, factors such as new EU regulations, Canadian sawlog costs, US tariff policy, possible changes to the Russian trade ban, and the pace of sawmill investments in the US could reshape trade flows.

Conclusion

Europe’s lumber market is entering a period of tightening supply and gradually recovering demand. While production growth is expected to shift toward Northern and Eastern Europe, overall expansion will be limited by structural harvest constraints in Central Europe. Stronger domestic consumption, combined with potentially higher US demand due to tariffs and reduced Canadian output, will likely support higher prices for logs and lumber. Europe will remain a critical global supplier, but competition for available fiber will intensify through 2030.

For more information about the new market report or to order, please visit:

• https://www.okelly.se/shop/lumber2025

About the Authors

Håkan Ekström

Håkan Ekström

Mr. Ekström is a leading expert on international forest products markets, with more than 35 years of experience in wood products utilization, international marketing, wood supply and demand analysis, and price forecasting. He has conducted on-site industry assessments in over 25 countries and currently leads Global Wood Trends, a Seattle-based consultancy specializing in international forest industry analysis.

Previously, he served as an international forest products analyst with ResourceWise and spent 30 years as president of Wood Resources International (WRI), an internationally recognized firm founded in 1987. WRI also produced two prominent quarterly wood market price reports that tracked global wood prices for over 35 years.

Global Wood Trends (United States)

Håkan Ekström | 📧

Glen O’Kelly

Glen O’Kelly

Glen is the owner and director of O’Kelly Acumen, based in Stockholm, Sweden. He has worked with the forest industries globally for 25 years, across the full value chain from forestry to wood products, pulp and paper, and bioenergy – on topics ranging from markets, strategy, procurement, and manufacturing. His experience includes forest management roles in New Zealand and Sweden, and business consulting with McKinsey & Company for 17 years where he served executive-level clients in leading forestry and forest products companies globally. For many years, he led McKinsey’s global Paper & Forest Products research and expert team. Since 2021, Glen has led O’Kelly Acumen, a business providing distinctive market intelligence and consulting services to clients worldwide.

O’Kelly Acumen (Sweden) — www.okelly.se

Glen O’Kelly | 📞 +46 73 56 98 039 | 📧