Last year, we examined how the COVID-19 pandemic supercharged the packaging and corrugated sector – a piece in which we analyzed the various effects and opportunities it has since created for the Pulp and Paper industry.

We have also continuously discussed the increasing momentum sustainability-related initiatives have gained and the importance that is being placed on environmental, social and corporate governance (ESG) issues at the individual company and global levels.

This evolving dynamic has prompted an important question for online retailers: How might they respond to the surge in e-commerce and consequently the need for more packaging, while also adhering to their sustainability goals?

Some of the various answers to this question are driven by new opportunities for players within the Pulp and Paper industry. Fisher International has the resources to help its customers pinpoint those opportunities and optimize their assets in order to fulfill the needs and requirements many large companies are seeking.

Consulting on New Sustainable Packaging Solutions

Many companies continue to research ways in which they can reduce packaging waste throughout the e-commerce supply chain. This has acted as an incentive for producers within the industry to create optimized e-commerce packaging that saves space and materials without compromising product protection, while also adhering to certain sustainability goals.

Fisher International, in union with our partner companies Forest2Market and Tecnon OrbiChem, provides consulting services that deliver a sound understanding, insights, and analysis of product competition across multiple value chains – which is critical when developing alternative packaging solutions.

A recent case study involves our work with a global material technology company. With nearly half of all global emissions coming from product manufacturing, one of the company’s missions is to aid in the world’s transition to sustainable materials through, but not limited to, the production and commercialization of 5-chloromethylfurfural (5-CMF) using wood cellulose feedstock – which would be a carbon negative solution for automotive parts, recyclable packaging, and many other applications normally produced from petroleum. 5-CMF is a building block that can be converted into paraxylene, a chemical intermediate used in the manufacture of PET, which has sparked the interests of beverage brand owners such as Danone, Nestlé and PepsiCo, as well as Ford Motor Company, PrimaLoft, and other companies seeking sustainable materials.

This particular company relied on the breadth and depth of industry data provided to them through the FisherSolve Next business intelligence platform to identify and screen potential pulp manufacturing sites that could potentially host its upcoming production based on a unique set of criteria.

Carbon Benchmarking

Recently, we’ve seen several major brands announce ambitious goals to significantly cut their carbon emissions in combination with both drafted and enacted legislation in several parts of the world that aims to reduce national and global CO2 levels. It’s not a matter of “if,” but “when” carbon costs begin to impact participants across the global supply chain – from manufacturing all the way to the point of sale. This will force large retailers and the companies who supply them to focus on their individual carbon footprints that encompass everything from transportation to packaging in order to achieve sustainability goals.

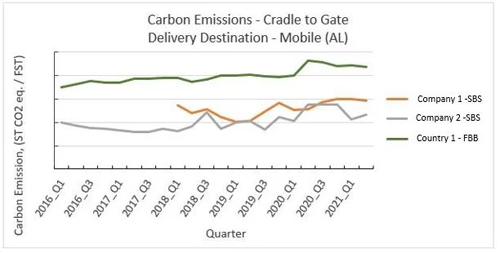

With Fisher International’s Carbon Module, players within the industry can see the carbon output of every pulp line and paper machine around the world for each of the products produced. From cradle to destination, our tool illustrates a full-spectrum view of carbon emissions of various scopes, which allows for strategic analysis of markets, products and regions, meaningful benchmarking, and transparency into a metric that is shaping modern business strategy.

Below is an example of a graph produced from our module that illustrates the carbon footprint from cradle to gate to Mobile Alabama of two different companies and one specific country. Users can see the carbon intensity for the average ton produced in the country compared to that of the two major producers.

Source: FisherSolve Next

Source: FisherSolve Next

With a reliable ability to measure and benchmark carbon footprints, participants across the P&P value chain can make the necessary changes that better align with major e-commerce retailers’ environmental values and help push them towards their carbon-neutral goals.

Plant Data

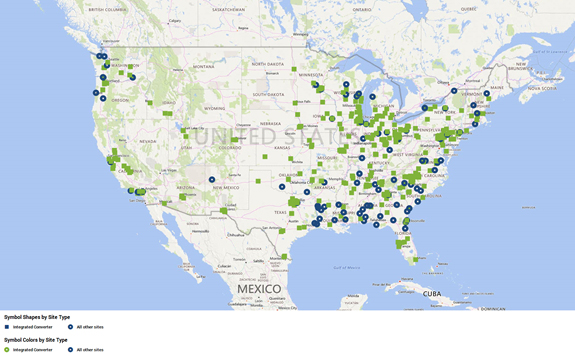

Major retailers and e-tailers are also looking to reach their sustainability goals by optimizing their supply chains and minimizing the distance between corrugated/packaging plants and their fulfillment centers. Fisher International maintains a vast database with current market integrations and true data transparency for every mill, line and machine in the world. With access to corrugated and kraft paper plant data, for instance, users get an overarching view of where these plants are located compared to the network of fulfillment centers.

For example, the image below illustrates Integrated Full Line Box Plants and Sheet Feeders in relation to Containerboard mills in the US. This is crucial information when determining how to minimize the distance between plants and suppliers, which will drive savings in both transportation and carbon costs, and improve operating margins.

Source: FisherSolve Next

Source: FisherSolve Next

Responding to market trends while simultaneously adhering to evolving social values and expectations can be difficult to navigate. With FisherSolve’s extensive interactive enhancements, participants across the pulp and paper value chain can access the quality data needed to inform and optimize their decision-making. speak with one of our experts today to learn more about how Fisher can help you prepare for a changing global economy.

Source: Fisher International