The pulp and paper industry is a dynamic and ever-evolving sector. Staying informed about price trends, demand patterns, and strategic moves others are making is essential for making informed business decisions.

To help you stay up to date with the latest trends in this industry, we have compiled some of the most significant industry developments from the third quarter.

Decline in Global Demand for Recovered Paper

According to its quarterly report released at the end of July, the Brussels-based Bureau of International Recycling (BIR) has stated that the recovered paper industry is facing significant challenges on a global scale.

According to Francisco Donoso, President of the BIR Paper Division, the current state of the market can be attributed to a significant lack of demand. The decrease in demand for packaging material is a direct result of reduced consumption of finished products.

Various factors, such as the financial crisis, high inflation rates, and the impact of the war in Ukraine, have contributed to this decline in demand. This means the economic stance of different regions will play a crucial role in determining the state of the recovered paper market in those areas.

Chinese paper mills have been particularly affected, currently operating at only around 70% due to minimal internal demand and relying primarily on external demand. The struggling Chinese and European economies have faced challenges in recovering from the impacts of the pandemic. However, there is a glimmer of hope with declining freight rates to Asia providing some relief in an otherwise weakened market.

On the other hand, the US has made a noticeable recovery, with the IMF upgrading its growth forecast for the country. Unlike other nations affected by higher oil prices, the US has been less impacted, and its consumers have shown a willingness to spend savings accumulated during the pandemic. This has resulted in increased economic activity and productivity compared to other countries.

In the words of IMF chief economist Pierre-Olivier Gourinchas, "The global economy is limping along, not sprinting."

Volatile Prices: The Ups and Downs of Q3

The pulp and paper industry has experienced significant price fluctuations this year, creating a volatile market. Let's take a closer look at the price changes observed in the third quarter.

- North American OCC and Mixed Paper Prices Jump in September – The average price for corrugated containers experienced a notable increase of $9 per ton last month. August saw prices at $54/ton, but by September, they had jumped to $63/ton. It's worth noting that this time last year, prices were significantly higher at $78/ton, decreasing $15 this year. Industry experts attribute these gradual price increases to the implementation of recycled fiber mill projects and a steady rise in overall demand for fiber in North America. On a similar note, mixed paper prices have also been on the rise, climbing by $8 and currently trading at $22/ton. A year ago, these prices were as low as $18/ton. Read more at www.resource-recycling.com

- Wastepaper Exports to Southeast Asia Face Lingering Stagnant Prices – Exported wastepaper prices to Southeast Asia have remained stagnant due to weak demand in the region and increased supplies from other countries. Cardboard waste from the US is currently trading at around US$150 to US$160 per ton, down from US$170 in late 2022. Similarly, wastepaper prices from Japan have dropped to US$150 from a recent peak of approximately US$280, while European wastepaper prices have fallen to US$120 to US$130 from US$270. The Southeast Asian paper mills are no longer eager to purchase wastepaper as exports of electronics and other products from the region to the US, Europe, and China have slowed down. Read more at www.asia.nikkei.com

- Paper Prices on the Rise in India – ITC, BILT Graphic Paper Products, and Andhra Paper have recently implemented price hikes ranging from INR 1,000-3,000 per ton across various paper and board grades due to a surge in demand and limited supply. The education sector and the booming e-commerce industry are the driving forces behind the increased demand for writing and printing paper. The scarcity of raw materials and rising prices have been the main factors contributing to the price increase. Experts in the industry predict that further price hikes can be expected. Read more at www.printweek.in

Mergers, Acquisitions and Divestments

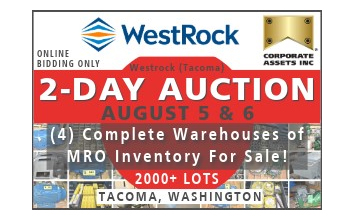

- Smurfit Kappa Merges with Westrock: Smurfit Kappa, the largest paper and packaging producer in Europe, is joining forces with Westrock, the second-largest packaging firm in the US, in a monumental $11 billion merger. The newly formed company will be known as Smurfit WestRock and is poised to become a dominant force in the packaging industry. With their combined expertise and resources, Smurfit WestRock is set to redefine the market and revolutionize packaging solutions on a global scale. Read more in our blog.

- West Fraser Sells Two Pulp Mills in Western Canada to Atlas Holdings: West Fraser Timber has entered into a definitive agreement with Atlas Holdings to sell its Quesnel pulp mill in British Columbia and Slave Lake pulp mill in Alberta. Upon completion of the transaction, Millar Western Forest Products, which became a part of the Atlas family of manufacturing and distribution businesses in 2017, will take over the operations of the Quesnel and Slave Lake pulp mills. The agreement also includes the transfer of related woodlands operations and timber holdings in Alberta, as well as a long-term fiber supply agreement for the Quesnel pulp mill. According to the company, the total cash proceeds from the sale amount to US$120 million. Read more at www.stocktitan.net

- Essity Completes Divestment of Its Operations in Russia: Essity, a leading hygiene and health company, has successfully sold off its operations in Russia to New Technologies, with Igor Shilov as the principal owner. This significant deal is valued at SEK 1.2 billion. In light of Russia's ongoing conflict with Ukraine, Essity has been committed to exiting the Russian market. This transaction marks the end of a long and intricate process. Read more at mb.cision.com

- Mondi to Acquire Hinton Pulp Mill from West Fraser Timber, Plans to Invest in Kraft Paper Production: Mondi, a leading global packaging and paper company, has announced its plans to acquire the Hinton pulp mill from West Fraser Timber. This strategic move will not only strengthen Mondi's presence in the Americas but also pave the way for a significant expansion of the mill. With a planned investment of €400 million, Mondi aims to enhance the production of kraft paper at the site, ensuring a long-term supply of high-quality products. The acquisition will also integrate Mondi's operations across the region and bolster its network of 10 paper bag plants. This transformative deal, valued at US$5 million, solidifies Mondi's commitment to sustainable growth and positions the company as a key player in the global paper industry. According to a recent release, the kraft paper machine is expected to be operational by the second half of 2027, pending pre-engineering and permitting processes. Read more at www.mondigroup.com

Explore more insights into emerging trends, future prospects, and more on our Forest Products blog.

Source: ResourceWise