Wood raw-material costs for sawmills in North America and Europe eased in the 3Q/22 as demand and prices for lumber fell.

A few countries faced slight log price increases in their local currencies, but with the strengthening US dollar, practically all markets worldwide had lower log costs in dollar terms compared to the 2Q/22. As a result, the Global Sawlog Price Index (GSPI) fell about five percent from its all-time high in the previous quarter. Since the index fell to a ten-year low in early 2020, it has climbed steadily and was up 40% over two years.

Unprecedented strong markets for wood products and record-high lumber prices caused record demand for wood raw-material in both Europe and North America during 2021 and early 2022. On a worldwide basis, softwood sawlog prices (in US$ terms) have gone up the most since 2020 in Brazil (+76%), Western Canada (+70%), Estonia (+68%), and Germany (+59%). Only the Nordic countries, Oceania, and China, have seen more modest price adjustments in the past few years.

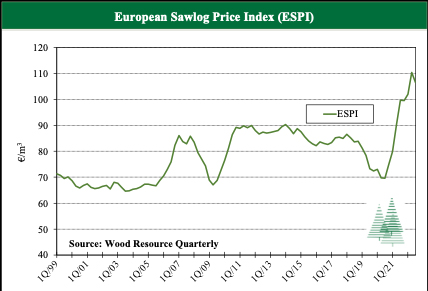

The European log market has undergone dramatic changes in supply and demand over the the past five years resulted in the most substantial price fluctuations the Wood Resource Quarterly has observed in almost 30 years of tracking wood markets. In 2017, sawlog prices were at levels that had been practically unchanged for nearly a decade. The situation changed when Central Europe was flooded with insects and storm-damaged timber in 2018-2020, and log prices fell to the lowest levels in over ten years.

High demand for lumber, declining availability of quality logs in the Czech Republic and Germany, and reduced log imports from Belarus, Russia, and Ukraine resulted in a surge in log prices on the continent. Consequently, the European Sawlog Price Index (ESPI) jumped over 40% from 3Q/20 to 2Q/22, reaching an all-time high of just over €110/m3 in the spring of 2022 (see chart). In the 3Q/22, lumber demand weakened, thus reducing upward price pressures on sawlogs and even declining prices in many markets.

Nevertheless, prices continued to be the highest in Central and Eastern Europe, while sawmills in the Nordic countries continued to have substantially lower raw-material costs than their European competitors.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices (WMP). The pricing data service, established in 1988, has subscribers in over 30 countries. The WMP tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WMP platform, a unique and valuable tool for every company and organisation that require updates on the latest developments of global forest products markets, please go to Global Wood Prices

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC