The global wood fiber market has changed substantially over the past three years.

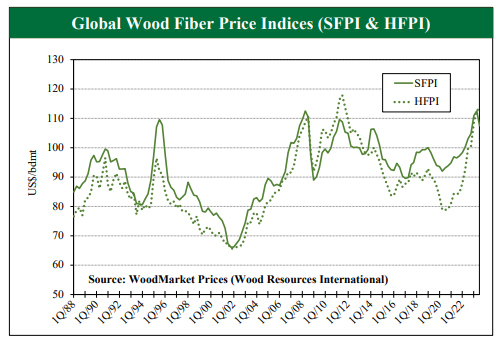

Interestingly, despite a worldwide decline in hardwood pulp prices in 2023, the supply of hardwood pulplogs tightened primarily because of Russia's invasion of Ukraine. This geopolitical event triggered a significant increase in hardwood fiber prices, which have outpaced the rise in softwood fiber prices and led to a 44% surge in the Global Hardwood Fiber Price Index (HFPI) since late 2020 (see chart). According to Wood Resources International, this upward trajectory continued into the third quarter of 2023 (3Q/23), during which the HFPI reached its highest level in over ten years. The most significant price increases of hardwood pulpwood occurred in Brazil, Germany, France, Finland, Sweden, and Eastern Canada.

However, not all regions experienced this surge. Notable price declines in the past year occurred in the US, Spain, and Australian domestic markets. Furthermore, China, a significant importer of wood fiber, saw import prices fall by over 20%.

In contrast to the hardwood market, the recent dynamics for softwood wood fiber have been different. Lower pulp production in North America and Europe and declining prices for softwood pulp globally have reduced demand for wood fiber. This decrease has put downward price pressure on softwood wood chips and pulplogs.

In the third quarter of 2023, the Softwood Fiber Price Index (SFPI) reported a decline of 4.5% from the second quarter of the same year. This fall was the most significant quarterto-quarter decline since 2015. Despite this quarterly decline, the index has seen an overall increase of 4.3% since the third quarter of 2022. Regions such as the US Northwest, US South, Western Canada, Austria, France, Spain, Chile, and Australia have experienced the most substantial price declines in US dollar terms. The recent drop in the SFPI occurred following an all-time high in the 2Q/23.

Pulpmills in the US and Latin America currently have the lowest-cost wood fiber worldwide, while producers in the Nordic countries have the highest costs. Significant changes in the ranking for softwood fiber costs during the past two years include the US South, which moved from #6 to #2, and Spain from #12 to #8. During the same period, Brazil's ranking fell from #1 to #5, and Germany's from #5 to #10. The most significant ranking improvements for hardwood fiber occurred in the US Northwest, Spain, and Australia, whereas pulpmills in Brazil, France, and Germany have lost competitiveness since 2021.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. WoodMarket Prices tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WoodMarket Prices platform, a unique and valuable tool for every organization that requires updates on the latest developments of global forest products markets, please go to www.resourcewise.com/platforms/woodmarket-prices.

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC