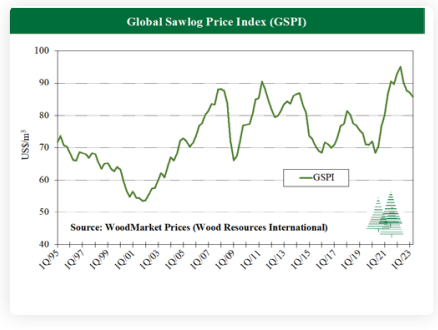

The Global Sawlog Prices Index (GSPI) fell 1.6% in the 2Q/23 quarter-over-quarter (QoQ).

Yearover-year (YoY), this fall represented almost a 10% decline compared to the 2Q/22 when it hit its all-time high (see chart). Although sawlog prices have moved downward in most of the 20 countries the index tracks, a few regions, including the Nordic countries and Latin America, have seen rising log prices over the past year.

Lower demand for wood raw materials, driven by weaker lumber markets worldwide, has been the significant factor in recent decreases in timber prices. In Western North America, where most sawmill curtailments have occurred in 2023, sawlog costs were down the most. Sawmills in British Columbia saw log costs falling by 20-25% from 2022, reaching the lowest level in over two years according to Wood Resources International.

Despite the recent decline, lumber manufacturers in this region still have the highest wood costs on the continent. Current prices are 25% higher than their 10-year average.

Sawlog prices in the US South rose slightly during 2022. However, in the 2Q/23 they were down by about 8% YoY to a level close to the lowest seen in over 25 years (in nominal terms). Although the average log costs for the southern states have varied in a narrow range of $57-62/m3 over the past two decades, there are significant variations between sub-regions.

In Coastal Georgia, South Carolina, and Florida, market prices reached over $70/m3 in 2022 and 2023. In regions where investments in sawmill expansion have been more modest, prices were closer to $50/m3.

Sawmills in Finland and Sweden have experienced a different timber market than most other regions over the past two years. Finnish sawmills were cut off from Russian log imports in 2022, and as a result, domestic log prices increased about 10% in Euro-terms. The availability of logs in the Baltic Sea region tightened in 2022 and 2023, with shipments from Belarus, Russia, and Ukraine being halted by the Russian invasion of Ukraine.

Swedish sawmills have increased imports of higher-cost logs from Estonia and Latvia and have also offered higher prices to domestic sawmills in 2023. Import prices from the Baltic States to Sweden have increased by almost 60%, in Swedish kronor, from early 2022 (before Russia’s invasion of Ukraine) to the average price for the first half of 2023. During the same period, domestic sawlog prices in Sweden have increased by less than 15%.

Wood Resource Quarterly has been digitized and is now available as an interactive online business intelligence platform, WoodMarket Prices. The pricing data service, established in 1988, has subscribers in over 30 countries. WoodMarket Prices tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the WoodMarket Prices platform, a unique and valuable tool for every organization that requires updates on the latest developments of global forest products markets, please visit www.resourcewise.com/platforms/woodmarket-prices.

Contact Information

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

Hakan Ekstrom

Hakan Ekstrom

Wood Resources International LLC