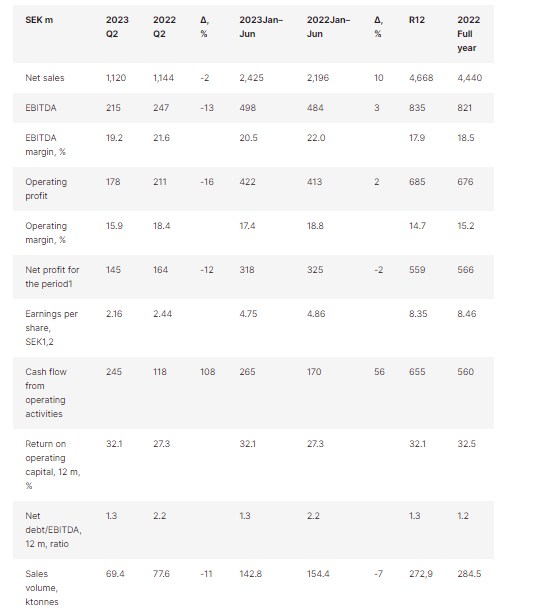

- Net sales amounted to SEK 1,120 (1,144) m, a decrease of 2% compared with the same quarter the previous year. Excluding currency effects, the decrease amounted to 8%.

- EBITDA amounted to SEK 215 (247) m corresponding to an EBITDA margin of 19.2% (21.6%).

- Operating profit amounted to SEK 178 (211) m, corresponding to an operating margin of 15.9% (18.4%).

- Profit for the period amounted to SEK 145 (164) m and earnings per share amounted to SEK 2.16 (2.44).

- Cash flow from operating activities was SEK 245 (118) m.

- Return on operating capital, 12 months, was 32.1% (27.3%).

- The net debt/EBITDA ratio, 12 m, was 1.3 (2.2).

- The sales volume amounted to 69.4 (77.6) ktonnes.

Key Figures

1 Net profit R12 and for full-year 2022 includes a capital gain in net financial items of SEK 42 million from the sale in Q4 2022 of the minority shareholding in Åmotfors Energi AB.

2 Before and after dilution

This is information that Nordic Paper Holding AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact person above, at 7.30 am CEST on 20 July 2023.

Nordic Paper is a leading specialty paper producer with its base in Scandinavia. We have been manufacturing top-quality kraft papers and natural greaseproof papers since the 19th century. Our products are based on renewable raw material from local forests. From our five paper mills, four in Scandinavia and one in Canada, we supply customers in 85 countries. Nordic Paper had in 2022 net sales of SEK 4,440m, about 670 employees and is listed on Nasdaq Stockholm. www.nordic-paper.com

Source: Nordic Paper